Viagogo's UK Operations Face Major Tax Demand

Two British divisions of the controversial ticket resale platform Viagogo have been slapped with a substantial £15 million tax bill following an investigation by HM Revenue and Customs. The tax authority discovered the companies had not paid sufficient duty during a specific period between 2016 and 2018.

Transfer Pricing Investigation Uncovered

Corporate filings for VGL Services and IFOT Services, both operating under the US-listed StubHub group that includes Viagogo, reveal both entities allocated funds to cover costs resulting from what they described as a "transfer pricing inquiry with HMRC".

Transfer pricing refers to how different entities within larger corporate groups charge each other for services or goods exchanged between them. Tax authorities closely monitor these transactions to ensure they occur at genuine market rates, preventing companies from artificially inflating prices to shift profits from high-tax to low-tax jurisdictions.

The accounts didn't provide specific details about HMRC's findings regarding Viagogo's tax arrangements, and there's no indication the company deliberately attempted to avoid or evade tax payments.

Payment Structure and Company Response

During the investigated period, the UK businesses didn't directly sell tickets but supplied services to other group companies, including providing technology solutions and customer support operations.

The combined £15 million set aside by both companies, registered to an address on London's Cannon Street, includes interest HMRC would have earned on the tax receipts had they been paid on time, along with late payment charges.

In their official filings, the businesses expressed their belief that HMRC's findings have resulted in "double taxation" - where a business faces taxation on the same activity in two different countries.

The companies confirmed they've now revised their transfer pricing policy while simultaneously seeking "remediation" under the UK's tax agreements with other nations, which might provide future financial benefits.

So far, the firms have paid £5.5 million collectively earlier this year, though they noted the "timing of further payments and settlement remains unclear."

Broader Context and Industry Scrutiny

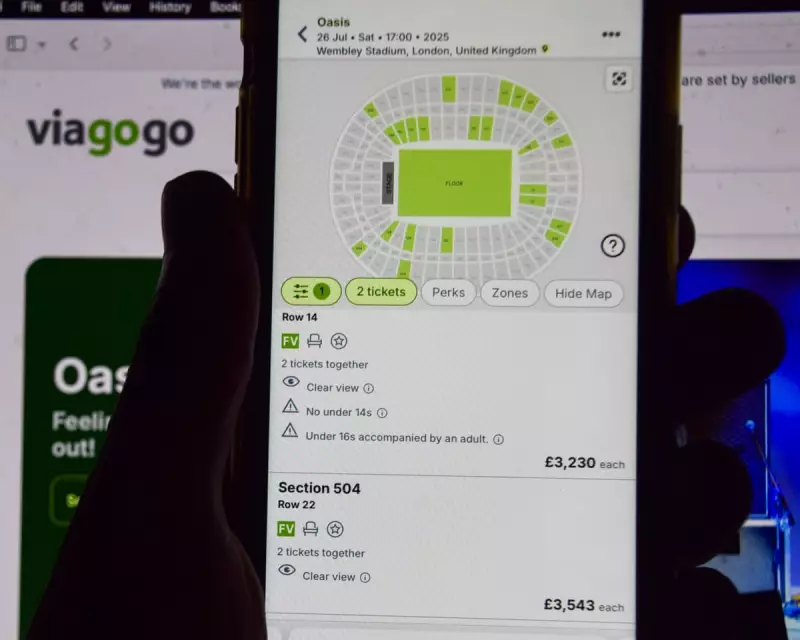

This tax development emerges as Viagogo faces intense scrutiny from UK authorities, with the government moving toward reviewing secondary ticketing practices. This review is expected to introduce a cap on ticket resale prices following public outrage over ticket touts exploiting such platforms to profit from genuine fans.

Any such regulatory changes in one of its key markets could significantly impact Viagogo's operations. The platform's parent company, StubHub Holdings, launched on the US Nasdaq index in September with an initial valuation of $8.6 billion, though this has since decreased to approximately $6.6 billion.

It's important to note that StubHub Holdings operates separately from StubHub International, which includes the UK brand of the same name. The Competition and Markets Authority mandated this separation to maintain market competition after Viagogo and StubHub agreed to merge.

Viagogo representatives did not respond to requests for comment regarding the HMRC investigation and resulting tax bill.