Waterstones Chief Defends Government's Business Rates Approach

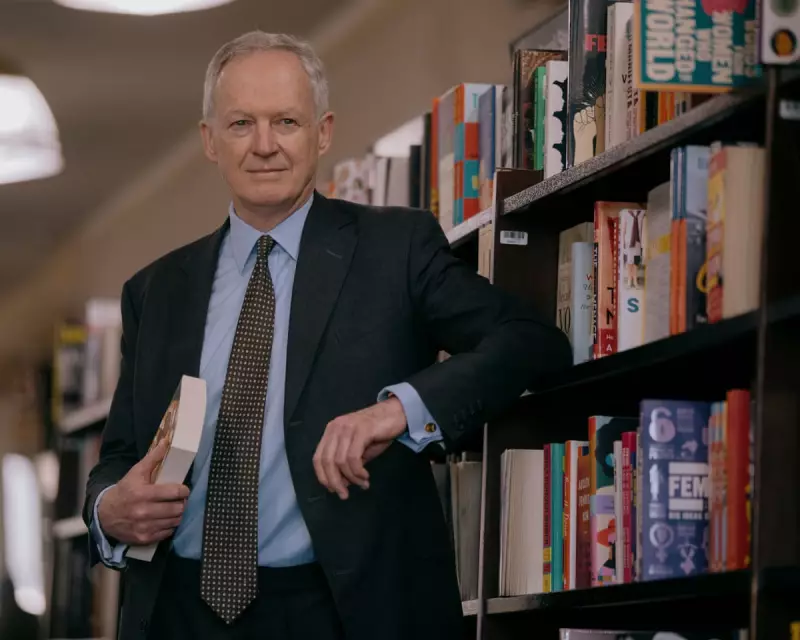

The managing director of Waterstones has publicly supported the government's controversial business rates reforms, arguing they represent a "sensible" approach to supporting Britain's high streets. James Daunt, who oversees the bookselling chain with 316 UK outlets including Foyles and Blackwells, believes the changes will ultimately benefit retailers in economically challenged areas.

Balancing Rates Across Different Locations

Daunt explained that while Waterstones' flagship store on London's Piccadilly faces substantial rate increases, these are being offset by "quite significant" reductions at shops in more troubled locations. The company's total business rates bill for this year is expected to remain similar to last year's despite these adjustments.

"Our main advantage is that we will get neighbours back again," Daunt stated, specifically mentioning towns like Newport in Wales, Grimsby in Lincolnshire, and Barrow-in-Furness in Cumbria. He suggested that lower business rates might encourage other retailers to reopen in these areas, potentially revitalising local high streets.

Contrasting Views Within the Bookselling Sector

Daunt's position contrasts sharply with concerns expressed by the Booksellers Association, which represents thousands of independent bookshops across the country. Meryl Halls, managing director of the association, warned that "the government's business rates reforms risk being deeply damaging, particularly for small and medium-sized bookshops."

A recent survey conducted by the association revealed that 85% of member bookshops were less likely to invest in stock, staffing, events, or premises improvements as a direct result of the business rates changes announced in the Westminster budget.

Financial Performance and Expansion Plans

New accounts filed at Companies House show Waterstones' UK trading arm achieved sales of £565.6 million in the year to 3 May 2025, representing a 7% increase. While pre-tax profits declined by approximately £3 million to £40 million, this was largely attributed to a £2.6 million one-off cost related to a cyber-attack on the company's supplier, Blue Yonder.

The company distributed nearly £34 million in dividends to its private equity owner, Elliott Investment Management, during 2024-2025. This follows reports that Elliott has engaged advisers to explore a potential public listing for the bookseller, either in London or the United States.

"I am very relaxed about a potential IPO," Daunt commented, noting that private equity firms typically sell businesses they have invested in. "That's what private equity do." He added that Elliott had acquired Waterstones for a modest sum and had successfully turned around the company's US operations, which include the Barnes & Noble chain.

Positive Trading Conditions and Social Media Influence

Daunt reported that Waterstones experienced strong trading through Christmas and into January, with book fans increasingly inspired by social media platforms including TikTok. "Bookselling is enjoying a nice time," he observed. "We had a good Christmas and January. It is not just us, independents are also doing well. It has been very good since the pandemic."

The company plans to continue its expansion with approximately 10 new store openings annually in the UK. Daunt noted that reading trends are evolving, often driven by social media recommendations, leading to unexpected bestsellers like Mona's Eyes, a translated French novel by Thomas Schlesser that gained popularity over Christmas in the US market.

Broader Context of Government Policy

Daunt's comments come amid wider debate about the government's approach to business taxation. Chancellor Rachel Reeves has faced criticism from leisure businesses, particularly pubs facing average rate increases of 76% over the next three years. While the government has promised support packages for pubs, these measures will not extend to the broader hospitality sector.

Regarding other employment costs, Daunt expressed relative unconcern about the higher legal minimum wage and increases to employers' national insurance contributions implemented last April. While acknowledging these added to Waterstones' costs, he described them as "manageable and reasonable" from the company's perspective.

Daunt contrasted the current government's approach with previous Conservative administrations, stating he had "been complaining long and hard all through the Conservative years about government failing to support the high street and particularly less affluent high streets." He believes the Labour government is now attempting to implement sensible measures to assist struggling retail areas.