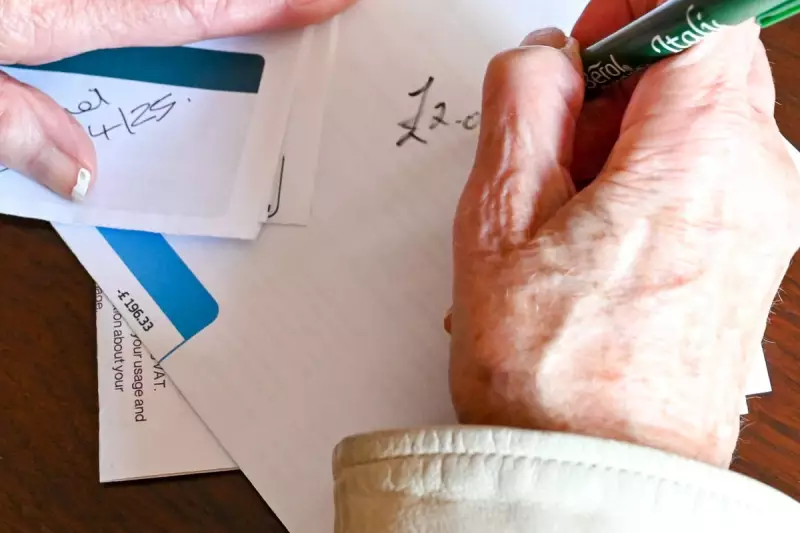

A significant new study has exposed the immense administrative burden facing the UK's self-employed workforce, revealing they sacrifice the equivalent of two full working days each month to business paperwork.

The Hidden Cost of Being Your Own Boss

The research, commissioned by Virgin Money, found that the typical self-employed worker spends 17 hours every month on tasks like managing client communication, logging receipts and expenses, and filing tax returns. This is time that could otherwise be used to generate income, with the study estimating this admin drain costs solo entrepreneurs up to an extra £3,000 per year in lost earnings.

A poll of 500 self-employed individuals and small business owners uncovered the deep-seated anxiety surrounding financial paperwork. A striking 45 per cent admitted they 'dread' tax return season and actively put it off for as long as possible. For more than half (53 per cent), it represents the most stressful period of their entire year.

Administrative Overload Leading to Business Mistakes

The burden of admin is having tangible negative effects on small businesses. The research revealed that 21 per cent of respondents have missed collecting a payment from a client due to being overwhelmed by paperwork. Furthermore, 16 per cent confessed to failing to pay a supplier on time for the same reason.

This administrative strain is causing many to question their career choice. Almost half (45 per cent) stated that handling business admin is the worst part of being their own boss. Alarmingly, it has led 22 per cent to consider returning to employment simply to escape the responsibility of managing their own finances and paperwork.

A Digital Solution on the Horizon

The study also highlighted a significant knowledge gap concerning upcoming government changes. From April next year, sole traders with a qualifying income over £50,000 will be required to switch to digital-only tax returns under the Making Tax Digital initiative. However, 45 per cent of those polled were unaware of this change, and a further 63 per cent did not know they would be expected to provide quarterly updates on their earnings.

Simon Norman, Head of Business Bank at Virgin Money, commented on the findings: "Doing your tax return doesn't have to be daunting, but our research has shown it's a real headache and many see tax admin as the biggest stress of their jobs. Government changes are on the way, so it's important those affected by these updates are aware of what's coming and are ready for a smooth switch to digital tax returns."

To help ease the transition, Virgin Money is offering customers of its M Account for Business six months' free access to the accounting app Xero, which is recognised by HMRC. The bank is also emphasising the benefit of using a separate business account, as the research found that 47 per cent of self-employed people use their personal current account for both work and personal finances, complicating their admin further.

Norman added: "With important changes coming, it's essential self-employed people and small business owners are preparing now... having a separate business bank account is a great way to make the process even smoother."