JP Morgan Strengthens UK Digital Wealth Arm with WealthOS Acquisition

In a strategic move to bolster its digital wealth management capabilities, global banking giant JP Morgan Chase has acquired WealthOS, a British pensions technology platform. The deal, confirmed through an internal memo from JP Morgan's Nutmeg personal investing division, marks another significant step in the American bank's expansion into the UK's competitive financial technology sector.

Strategic Acquisition to Enhance Retirement Planning Services

The purchase of WealthOS represents JP Morgan's continued investment in augmenting its retirement planning and personal investing services for UK clients. WealthOS, founded in 2019 and chaired by former Google executive John Herlihy, specialises in wealth management software solutions that JP Morgan believes will provide cutting-edge technology and deep sector expertise to its existing operations.

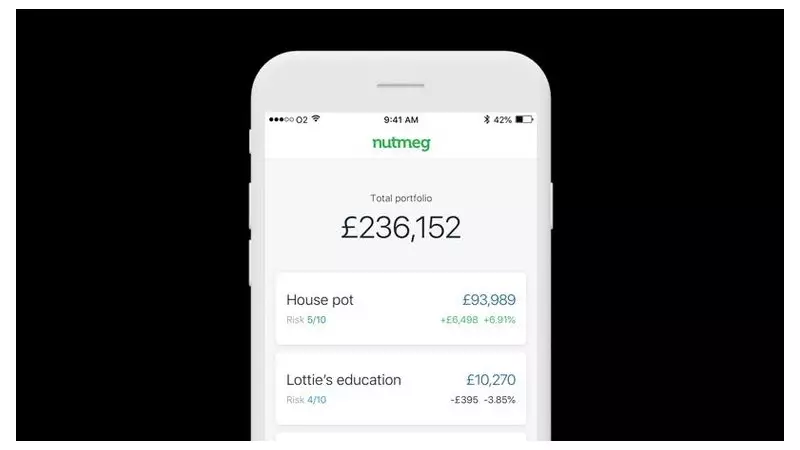

This acquisition follows JP Morgan's previous major UK market move in 2021, when it acquired digital investment platform Nutmeg for a reported £700 million. Nutmeg currently serves approximately 275,000 customers across the United Kingdom, providing the foundation upon which JP Morgan is building its comprehensive digital wealth management offering.

WealthOS: A Technology Platform with International Reach

WealthOS operates as a sophisticated wealth management software business with a workforce distributed between the United Kingdom and Sri Lanka, where it maintains a dedicated product and software engineering centre. The company's technology platform is specifically designed to support pension administration and wealth management services, making it an ideal strategic fit for JP Morgan's ambitions in the UK retirement planning market.

While the financial terms of the acquisition remain undisclosed, the deal was announced internally this week and represents JP Morgan's latest effort to strengthen its position in the UK's rapidly evolving digital banking landscape. The American banking behemoth has made substantial progress in the UK personal banking and wealth management sector in recent years, having launched its digital savings bank under the Chase brand in 2021 alongside the Nutmeg acquisition.

JP Morgan's Growing UK Digital Presence

This latest acquisition demonstrates JP Morgan's commitment to establishing a comprehensive digital financial services ecosystem in the United Kingdom. By integrating WealthOS's technology platform with Nutmeg's existing customer base and Chase's digital banking infrastructure, JP Morgan is positioning itself to offer UK consumers a more integrated and technologically advanced suite of wealth management and retirement planning services.

The banking giant has declined to comment publicly on the transaction, but internal communications indicate that the WealthOS acquisition will provide valuable technological capabilities that complement JP Morgan's existing UK operations. This strategic move comes as traditional banking institutions increasingly compete with fintech startups in the digital wealth management space, with technology becoming a crucial differentiator in attracting and retaining customers.

As JP Morgan continues to expand its UK footprint through strategic acquisitions like WealthOS, the banking landscape in Britain is witnessing increased competition and innovation in digital financial services, particularly in the wealth management and retirement planning sectors that are undergoing significant technological transformation.