The price of gold has surged to a fresh all-time high, breaching the $4,500 per ounce mark as investors seek safety from escalating geopolitical tensions and anticipate further interest rate cuts from the US Federal Reserve.

Metals Rally on Geopolitical Heat and Rate Cut Hopes

On Tuesday 23 December 2025, the precious metal climbed to $4,497 in early trading, closing in on the $4,500 threshold. This follows Monday's milestone, where an ounce of gold crossed the $4,400 level for the very first time. The rally is not confined to gold; silver also experienced a significant surge, circling the $70 mark and reaching a high of $69.44.

Axel Rudolph, a senior technical analyst at IG, explained the trend. "Gold and silver prices have surged to record highs as expectations of further Fed rate cuts, escalating geopolitical tensions, strong central bank and ETF demand, and robust industrial use – particularly for silver – drive investors towards safe-haven assets over yield," he said.

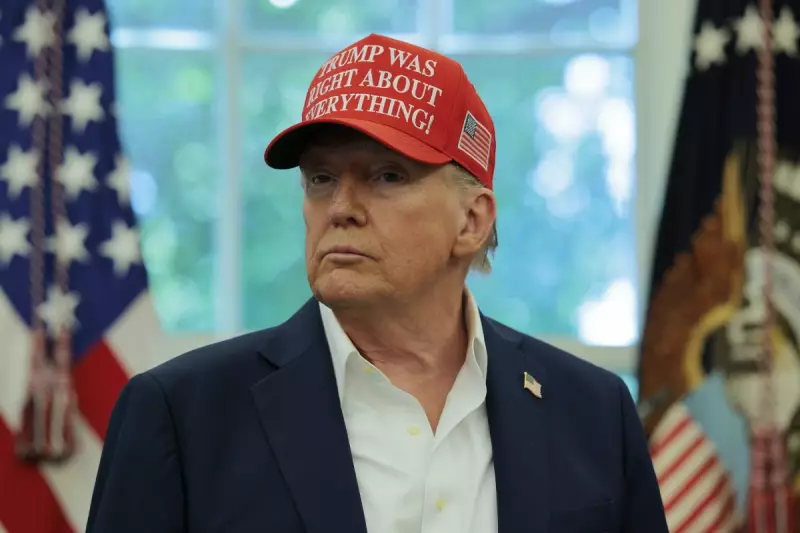

Trump's Venezuela Actions Rattle Markets

The immediate catalyst for the latest spike in volatility is President Donald Trump's aggressive stance towards Venezuela. The US has blocked and seized Venezuelan oil tankers, with Trump confirming the pursuit of a third vessel after two were taken earlier this month.

The White House alleges that Venezuela uses oil revenue from these tankers to fund drug-related crime. Trump stated the US plans to retain the seized assets, noting discussions with "big" American oil companies. "We’re going to keep it… maybe we’ll sell it, maybe we’ll keep it. Maybe we’ll use it in the strategic reserves. We’re keeping it, we’re keeping the ships also," he said.

This action spooked investors, prompting a flight from assets perceived as more volatile, such as US stocks or the dollar. The DXY dollar index fell 0.2 per cent to 98.09 on Tuesday morning, retreating from a prior high of 98.73.

A Sustained Bull Run for Precious Metals

The current rally extends a long-term bull market for gold. Since President Trump ignited a global trade war in April, the price of gold has risen over 70 per cent. The metal has received a substantial boost from the Federal Reserve's recent decision to cut interest rates, which reduces the opportunity cost of holding non-yielding assets like gold.

Oil markets also reacted to the Venezuela news, with the price of a barrel of Brent crude spiking to highs of $77, though it later surrendered some of those gains. The concurrent movements in gold and oil underscore how geopolitical flashpoints are reshaping global commodity markets, driving capital towards traditional safe havens.