Financial market infrastructure operators, including some of the world's largest exchanges, have issued a stark warning that the advent of quantum computing represents a high-impact risk that could undermine the very security of global trading systems.

The Quantum Threat to Financial Security

The warning forms a key part of a detailed systemic risk survey conducted by the Bank for International Settlements' Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO). Published in late 2023, the survey gathered insights from 29 financial market infrastructures (FMIs) across the globe, responsible for clearing, settling, and recording trillions in transactions.

While cyber threats and operational resilience topped the list of concerns, a significant new entry was the risk posed by quantum computing. The technology's potential to break current cryptographic standards was highlighted as a particular danger. Most critically, the report noted that over 40% of the responding FMIs have not yet begun preparing for this quantum future, a state of readiness described as being in its early stages.

The Race for 'Crypto-Agility'

The core of the threat lies in public-key cryptography, the digital lock and key securing everything from online banking to stock trades. Quantum computers, leveraging the principles of quantum mechanics, could one day solve the complex mathematical problems underpinning this security with ease, rendering current defences obsolete.

In response, the financial sector is now engaged in a urgent race for crypto-agility. This concept refers to the ability of an organisation's systems to swiftly transition to new, quantum-resistant cryptographic algorithms once they are standardised. The goal is to have this capability before a cryptographically relevant quantum computer is built, a potentially narrow window of opportunity.

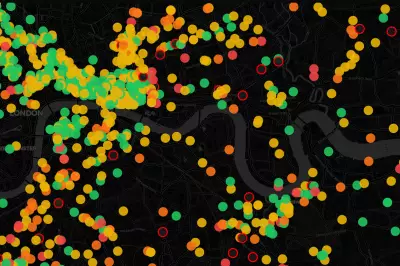

The London Stock Exchange Group (LSEG) is among the institutions actively monitoring this space. A spokesperson confirmed they are tracking developments in quantum computing and post-quantum cryptography closely, working with regulators and peers to understand and mitigate the evolving threat landscape.

Beyond Cryptography: A Double-Edged Sword

The report also cautions that the risks are not limited to breaking encryption. Quantum computing presents a dual-use challenge. On one hand, it threatens security; on the other, it could be harnessed to create powerful new financial tools for risk analysis and trading strategies.

This duality means the technology could potentially destabilise markets if deployed unevenly or maliciously. The survey respondents urged authorities to consider the broader financial stability implications, suggesting that future guidance from standard-setting bodies may be necessary to manage these advanced technological risks effectively.

The clear message from the world's financial plumbing is that quantum computing is no longer a distant theoretical concern. It is a high-impact, foreseeable risk that demands immediate attention and investment. The race to achieve crypto-agility is on, with the security of the entire global financial system potentially hanging in the balance.