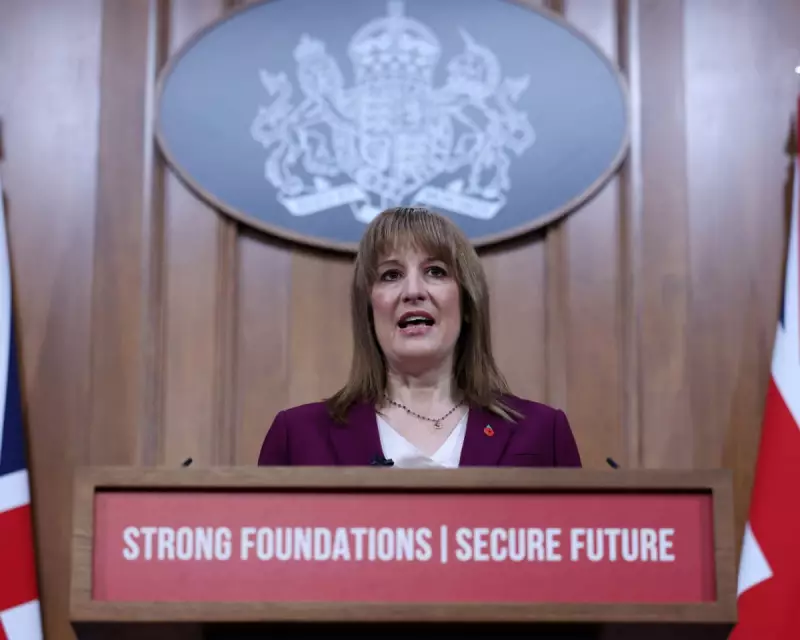

Chancellor's Pre-Budget Charm Offensive Aims to Quell Labour Backlash

Chancellor Rachel Reeves has launched an unprecedented charm offensive to prepare Labour MPs for potentially breaking a key manifesto pledge by raising income tax in her upcoming autumn budget. Downing Street insiders are openly discussing an imminent tax increase, with one source stating, "You don't exactly have to be a genius to have worked out we're doing it."

The government, despite its massive parliamentary majority, is treating this budget with extreme caution. One minister likened the challenge to "wrestling a squirrel across a minefield," highlighting that the biggest risk isn't from markets or business, but from their own backbenchers. This concern stems from recent welfare reform votes that demonstrated the parliamentary Labour party's willingness to flex its muscles.

Buttering Up MPs with Economic Lessons

No 10 has organised special "economic insight sessions" for Labour MPs featuring prominent economists and former ministers, including Kitty Ussher, James Kirkup, and Gregg McClymont. These private tutorials aim to explain the gravity of the Office for Budget Responsibility's productivity downgrade and rising government borrowing costs.

MPs are being courted with breakfast meetings at Number 10, while Chancellor Reeves has been holding regional listening sessions with small groups. The outreach reflects serious concern about a potential rebellion, particularly if the government breaks its manifesto commitment on taxes.

The Budget Board: A New Approach to Financial Planning

A significant departure from tradition is the creation of a "budget board" chaired jointly by Treasury minister Torsten Bell and the Prime Minister's chief economic adviser Minouche Shafik. This group, which includes senior figures from both No 10 and the Treasury, meets weekly to thrash out budget details using an online dashboard that shows the public and financial impact of each proposed measure.

One senior official explained the rationale: "One of the reasons we had the disaster with winter fuel payments is that Downing Street was only brought into that decision at late notice. We're determined to make sure that never happens again."

The debate within government appears centred on how bold to be regarding fiscal headroom. Some advocate for significant tax rises now to avoid repeated budget crises, while others remain opposed to income tax increases. However, opponents seem to have lost the argument, with one Labour veteran warning that raising income tax would signal the government is "held hostage by our party."

Many backbenchers remain more preoccupied with ending the two-child benefit cap than potential income tax rises. Cabinet ministers are confident the controversial cap will be removed, and it featured prominently when Keir Starmer addressed the Parliamentary Labour Party recently.

Despite the controversy, some senior MPs argue for confronting the fiscal reality head-on. One minister suggested Reeves and Starmer should explicitly apologise for making the tax pledge while explaining how the rises would rebuild public services and fuel economic growth. Another senior MP commented: "Best to go for broadest possible base now and hope for headroom towards end of parliament. Rip the band aid off."

The final budget outline remains subject to last-minute revisions from the OBR's forecast, leaving a small chance that income tax rises could still be averted if wage growth outperforms expectations. However, the Chancellor is determined to avoid the panic of last-minute changes that plagued previous budgets, making significant tax increases increasingly likely.