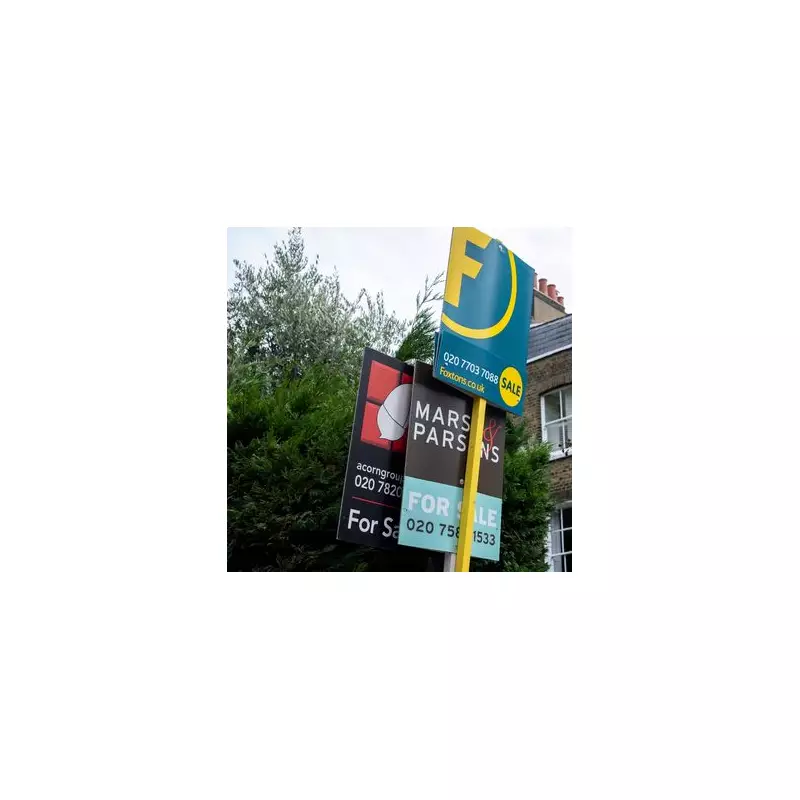

London has unseated the North East of England as the area of Britain where homeowners are most prone to sell their property for a loss, according to a major new analysis of the housing market.

A Stark Reversal of Fortunes

Research conducted by the estate agency Hamptons indicates a significant shift in the UK's property landscape. The study, which examined English regions and Wales, found that in 2025, 14.8% of sellers in London sold their home for less than they originally paid. This marks the highest proportion in the country and sits well above the national average of 8.7%.

This represents a dramatic change from the recent past. For nine out of the previous ten years, the North East held the unwanted title of the region with the most loss-making sales. As recently as 2019, a striking 29.9% of sellers in the North East took a loss, compared to just 9.2% in London. Experts attribute the North's former position to its slower recovery from the 2008 financial crisis.

Northern Growth Offsets Southern Stagnation

The turnaround has been driven by robust price growth in northern regions, which has bolstered returns for sellers there. Consequently, the proportion of loss-making sales in the North East fell to 13.9% in 2025. Hamptons describes this as a clear "reversal of fortunes" between the North and South.

In London, the growing trend of losses is largely concentrated among sellers of flats. Despite this, the average London seller in 2025 still achieved a substantial gross profit of £172,510 (44.6%) above their purchase price, though much of this gain stems from historic growth.

Nationally, the average homeowner in England and Wales sold their property last year for £91,260 more than they paid, a 41.0% increase over a typical ownership period of nine years. However, this figure is £570 less than the average gross profit recorded in 2024.

Expert Insight and Future Outlook

Aneisha Beveridge, Head of Research at Hamptons, commented on the findings. "In London, upward house price growth is no longer the one-way bet it once seemed," she said. "In some cases, even owners who bought a decade ago still face getting back less than they paid – something that would have been almost unthinkable in the heady days of 2015."

Ms Beveridge warned that over the next few years, more sellers are likely to have missed London's major pre-2016 boom, having bought near the market peak. "That could make trading up increasingly challenging," she added.

She noted that rising gains in the North have helped offset shrinking returns in the South, leaving the overall national picture broadly stable. With recent northern price growth now established, seller gains there could outpace the South for the foreseeable future.

The report concludes that if the financial numbers do not add up, many potential sellers may choose to stay put, keeping some homeowners, particularly those unable to secure a gain, out of the market entirely.

Regional Breakdown of Loss-Making Sales in 2025:

- London: 14.8%

- North East: 13.9%

- South East: 9.0%

- South West: 8.3%

- North West: 8.1%

- Yorkshire and the Humber: 8.0%

- East of England: 7.9%

- West Midlands: 6.9%

- East Midlands: 6.7%

- Wales: 6.2%

Average Cash Gains for Sellers in 2025 (with annual change):

- London: £172,510 (+£160)

- South East: £108,030 (-£8,530)

- South West: £91,890 (-£4,200)

- East of England: £97,130 (-£3,140)

- East Midlands: £70,730 (-£800)

- West Midlands: £76,220 (+£3,240)

- North East: £41,140 (+£2,920)

- North West: £70,520 (+£5,690)

- Yorkshire and the Humber: £62,180 (+£1,800)

- Wales: £68,120 (+£1,410)