Global Sport Group (GSG), the sports investment vehicle backed by private equity giant CVC Capital Partners, is on the verge of sealing a significant $300 million deal to acquire a majority stake in Equine Network, a prominent US-based equestrian sports league. This strategic move represents GSG's first new league investment since its formation and marks a substantial expansion into the American market.

Expanding the Sports Portfolio

Sky News has learned that negotiations are at an advanced stage, with industry sources indicating that an announcement could be imminent in the coming days. GSG, which already holds stakes in high-profile assets including Premiership Rugby, the commercial rights to Spain's La Liga, women's professional tennis, and Six Nations Rugby, is broadening its reach into equestrian sports through this acquisition.

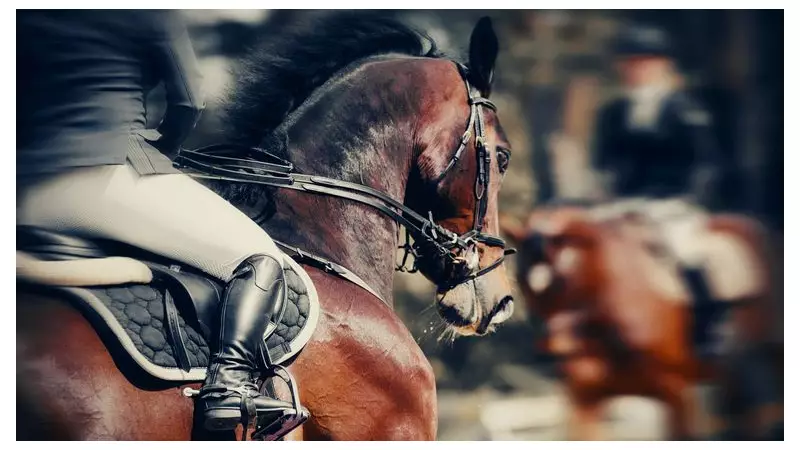

Equine Network operates a diverse range of equestrian competitions, from team roping rodeo events to prestigious showjumping tournaments. Under the leadership of chief executive Tom Winsor, the business has grown to encompass 40 owned and operated competitions, alongside more than 800 events managed by third parties. The league has capitalised on increasing spectator and participant interest across the United States, establishing itself as a profitable and rapidly expanding entity.

Financial Dynamics and Growth Strategy

A notable aspect of Equine Network's operations is its substantial allocation of competition revenues to prize money, with some tournaments offering funds reaching tens of millions of dollars to competitors. This model has helped attract top talent and boost engagement within the equestrian community.

The acquisition is expected to enhance GSG's exposure to the lucrative US sports market while integrating a fast-growing league into its portfolio. According to insiders, the deal will reinforce GSG's operational model, which leverages its network of sports industry executives to drive investment in technology infrastructure. This approach aims to expand fan engagement and unlock commercial opportunities in areas such as sponsorship and data services.

Broader Investment Context

This development coincides with GSG's preparations to secure billions of dollars in new debt and equity funding, as it aspires to become a global sports powerhouse. Earlier this month, Sky News revealed that GSG, chaired by former BT executive Marc Allera, has initiated a €2.7 billion debt refinancing process while engaging in discussions with third-party investors from the private equity sector.

GSG's existing interests extend beyond rugby and football to include stakes in the top flights of French football and international volleyball. The fresh capital raised is earmarked for acquiring additional assets in sports with strong commercial growth prospects, positioning the group for further expansion.

Long-Term Strategic Implications

Upon completion, the Equine Network deal will enable CVC to maintain its investment in the sports portfolio for an extended period. It also sets the stage for potential future transactions, such as the sale of a minority stake in GSG or an initial public offering on a major international stock exchange.

CVC Capital Partners, renowned for its lucrative ownership of Formula One—one of the most profitable deals in sports history—has been actively investing in leagues and elite sporting assets over the past two decades. The firm's strategy focuses on maximising commercial potential through new media and sponsorship rights deals, as well as expanding into formats designed to attract wider audiences amid evolving media consumption trends.

Despite the consolidation under the GSG umbrella, CVC's sporting assets will retain their autonomy and operate independently from one another. This structure is intended to foster innovation while allowing each entity to capitalise on its unique market position.

Industry Trends and Future Prospects

The GSG approach is anticipated to generate new investment opportunities, with CVC potentially eyeing further acquisitions in elite tennis tournaments. Global sports properties have emerged as a highly attractive growth area for private capital in recent years, with firms like Ares, Silver Lake Partners, and Bridgepoint making substantial investments across teams, leagues, and related assets.

As the sports investment landscape continues to evolve, deals such as the Equine Network acquisition underscore the increasing convergence of private equity and elite athletics. Both CVC and GSG have been approached for comment on the ongoing negotiations, highlighting the significance of this move within the broader sports industry.