Sheffield Wednesday Takeover Faces Extended Scrutiny Over Gambling Funding Concerns

The proposed takeover of Sheffield Wednesday Football Club has been plunged into uncertainty as the English Football League conducts a thorough investigation into the sources of funding for the preferred bidders. The EFL is examining whether the purchase would be primarily financed through proceeds from gambling and cryptocurrency gambling operations, potentially complicating the entire acquisition process.

Preferred Bidders Announced on Christmas Eve

Administrators for Sheffield Wednesday, Begbies Traynor, announced on Christmas Eve that they had selected a consortium as their preferred bidder to purchase the club. The consortium is led by two key figures: professional poker player James Bord and cryptocurrency gambling casino owner Felix Roemer. This consortium has reportedly paid a substantial multimillion-pound deposit to secure exclusive negotiating rights for the proposed acquisition, which is valued at over £30 million plus three years of operating costs.

Despite this progress, the takeover now faces significant regulatory hurdles. The EFL is currently assessing whether the bidders comply with the stringent requirements of its Owners' and Directors' Test. This process involves detailed due diligence on the origins of the funding, with particular focus on the involvement of gambling-related income streams.

Gambling Connections Raise Regulatory Questions

The involvement of Bord and Roemer in gambling enterprises has raised important questions about the suitability of their funding sources. James Bord, aged 44, has reported career poker winnings of approximately £3 million and has previously worked for data-driven betting businesses associated with other football club owners. Felix Roemer's wealth appears more directly linked to his ownership of Gamdom, a cryptocurrency gambling casino and sports betting site registered offshore in the Comoros Islands.

Gamdom has faced regulatory challenges in several European countries, including fines and bans for operating without proper licences in Spain, Sweden, and the Netherlands. These regulatory issues add another layer of complexity to the EFL's assessment of the bid's suitability.

Regulatory Landscape and Future Oversight

The timing of this takeover bid coincides with significant changes in football governance. At the end of the current season, responsibility for ownership assessments will transfer from the EFL to the newly established Independent Football Regulator. This regulator will inherit the Sheffield Wednesday case if the EFL's process remains incomplete, and possesses more extensive powers of investigation, sanction, and enforcement than the current governing body.

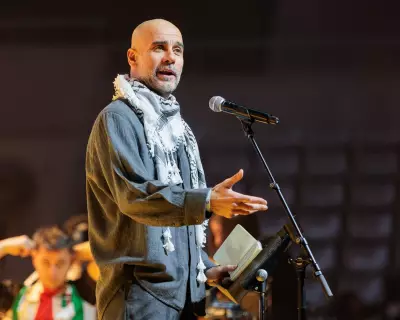

Clive Betts, Labour MP for Sheffield South East, has emphasised the importance of rigorous scrutiny despite his desire to see the club sold. "The source of funding has to be a concern, given the inherent volatility of those industries," Betts stated. "Even if the EFL approves the takeover, what level of sustainability is there? These are issues that need to be addressed."

Precedents and Potential Solutions

Other football clubs with connections to gambling enterprises have established precedents for such arrangements. Brighton & Hove Albion, owned by Tony Bloom, and Brentford, owned by Matthew Benham, both operate with special dispensation from the Football Association. This arrangement requires independent auditing of their betting consultancy accounts to ensure compliance with football betting bans.

Bord and Roemer would likely need to sign similar undertakings if their takeover proceeds, though it remains uncertain whether the Football Association would grant them equivalent dispensation. The FA is understood to be in communication with the EFL regarding this matter, highlighting the coordinated approach being taken to assess the bid's viability.

Financial Pressures and Club Operations

While the regulatory process continues, Sheffield Wednesday faces ongoing financial pressures. The administrators have taken measures to ensure the club can complete the season, including the recent sale of several players. Club captain Barry Bannan has departed for Millwall, while Chelsea has paid £500,000 for 17-year-old defender Yisa Alao.

Begbies Traynor maintains confidence in their preferred bidder despite recognising that the Owners' and Directors' Test process may require considerable time. The consortium's advisers have emphasised to media outlets that the bid is privately funded through investments in technology and analytics, though they have declined to provide specific details about these investments.

Broader Implications for Football Governance

This takeover bid represents a significant test case for football governance in the United Kingdom. The involvement of gambling-related funding sources, combined with the transition to the new Independent Football Regulator, creates a complex regulatory environment that will likely influence future club acquisitions.

As the EFL continues its detailed examination of the funding sources, the future ownership of Sheffield Wednesday remains uncertain. The outcome will not only determine the club's immediate future but also establish important precedents for how football authorities handle similar cases involving alternative funding streams in the evolving landscape of football finance.