European financial markets are braced for a volatile week after former US President Donald Trump renewed threats to impose sweeping tariffs on key allies, sending stock futures tumbling and investors scrambling for safe-haven assets like gold.

Tariff Threats Rattle Investors

The immediate trigger for the sell-off was a fresh threat from Trump to levy new trade tariffs on eight European countries: Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland. The plan outlines an initial 10% duty on goods starting 1 February, escalating sharply to 25% on 1 June. The move is reportedly linked to his longstanding ambition to acquire Greenland, demanding European support for the endeavour.

The reaction from investors was swift and severe. Futures for the pan-European Stoxx 50 index dropped 1.51%, indicating a poor opening for the continent's bourses. The French Cac 40 was poised for a 2.1% fall, while Germany's Dax pointed to a 1.35% decline. In London, futures for the FTSE 100 blue-chip index were down 0.48%.

Global Ripples and Safe Havens

The anxiety spread beyond equities. Oil prices retreated, with Brent crude falling 0.73% to $63.66 a barrel. The US Dollar also weakened. In a classic flight to safety, gold surged to a fresh record high of $4,689.39 per ounce, trading up around 1.6%. Spot silver also jumped approximately 3.8% to $93.39 per ounce after hitting its own peak.

Jim Reid of Deutsche Bank offered a note of caution, suggesting the initial shock might wane. He recalled that previous tariff announcements had been softened, and highlighted the US's "huge twin deficits" as a potential weakness. "While in many ways it feels like the US holds the economic cards, it doesn’t hold all the funding cards," Reid stated. He also questioned the domestic political benefit for Trump, citing a Reuters/Ipsos poll showing only 17% of US citizens supported efforts to acquire Greenland, with 47% opposed.

Europe's Diplomatic and Retaliatory Calculus

European leaders are now engaged in a frantic 12-day diplomatic push to avert the crisis. An emergency summit of EU leaders is likely scheduled for Thursday. The EU is actively considering its response, including the potential activation of its Anti-Coercion Instrument (ACI), which came into force in late 2023. However, this legal process could take months.

As a faster alternative, EU ambassadors have explored activating €93 billion in pre-prepared retaliatory tariffs designed in response to Trump's previous measures. The coming days will test European unity as it formulates a coordinated response.

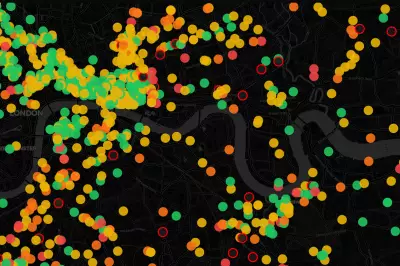

Amidst the international turmoil, Chancellor Rachel Reeves struck an optimistic note for the City of London. Speaking as new, simplified UK Listing Rules took effect to boost IPOs, she heralded a "new golden age for the City," citing record FTSE 100 highs and renewed global interest in London's capital markets.