The owner of Waterstones is taking a decisive step towards a blockbuster stock market listing, with plans to appoint investment bank Rothschild to advise on a multibillion-pound flotation that could significantly bolster the London Stock Exchange.

A Potential Lifeline for London's Listings Market

According to a report by Sky News, Elliott Management, the US hedge fund that owns Waterstones and its American sister Barnes & Noble, is close to hiring bankers to mount its market debut as soon as the second quarter of this year. A successful float of the beloved British bookseller in London would represent one of the most high-profile listings in years, offering a much-needed vote of confidence for a market that has suffered a prolonged drought in billion-pound IPOs.

The City has been hollowed out by a steady stream of takeovers, delistings, and a migration of growth companies to New York. Recent setbacks include the troubled Deliveroo float, which ended in a $2.9bn sale to DoorDash, and the buyout of cybersecurity firm Darktrace by private equity just three years after it went public. A Waterstones IPO would be seen as a major boost, potentially helping to turn the page on this dire run of form.

Strong Financials Underpin Daunt's Strategy

The potential listing comes on the back of robust financial performance. Waterstones' most recent accounts show the retailer made £528m in sales in the 2023-24 financial year, a notable 17 per cent increase on the previous year. More impressively, it turned a profit of £46m, up more than 50 per cent from £29m the year prior.

This growth has been driven by an aggressive expansion strategy under the leadership of James Daunt, who also owns his eponymous bookshop chain. Since taking charge in 2011, Daunt has opened dozens of new shops. After Elliott acquired Waterstones in 2018 and then snapped up Barnes & Noble in 2019 for $683m, Daunt was put in charge of both operations. Under his watch, Elliott has also acquired other iconic British booksellers including Foyles, Hatchards and Blackwell's.

London vs. New York: The Listing Decision

The final listing venue is yet to be confirmed, with both London and New York in contention. However, there are strong signals pointing towards the UK capital. Daunt attended a roundtable with Chancellor Rachel Reeves in October, where she made a case for the London Stock Exchange as a major listing venue.

Daunt has previously hinted that the City could be a natural home for Waterstones, describing the business as "a solid, predictable retailer with steady growth and dividend payouts" and likening it to high-street success story Next. Speaking to the BBC earlier this month, Daunt said an IPO was an "inevitability and better than being flipped to the next private equity person."

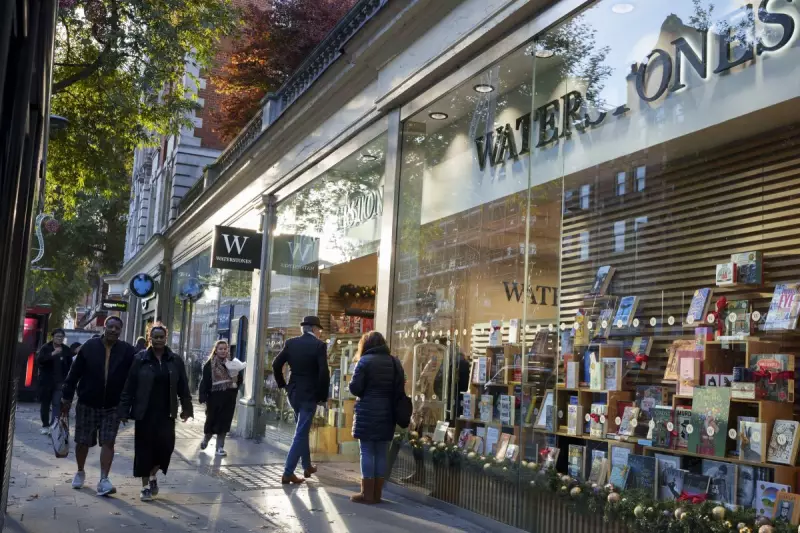

The Financial Times has previously reported that Elliott Management would appoint investment banks early this year, and it is expected the firm will line up several other banks alongside Rothschild. Waterstones currently trades from 316 stores in the UK, employing about 4,000 people, while Barnes & Noble operates from more than 600 locations in the US.