The owner of the Waterstones bookstore chain is taking a major step towards a blockbuster stock market listing, with plans to appoint the prestigious investment bank Rothschild as an adviser. Sky News has learned that Elliott Management, the US-based private equity firm, is finalising the appointment to guide the potential flotation of the transatlantic bookselling group.

London Poised to Win Listing Battle

According to City sources, the expected engagement of Rothschild is the strongest signal yet that London is likely to triumph over New York in the contest to host the initial public offering (IPO). The listing, which could value the business at several billion pounds, is now anticipated to take place as early as the second quarter of this year.

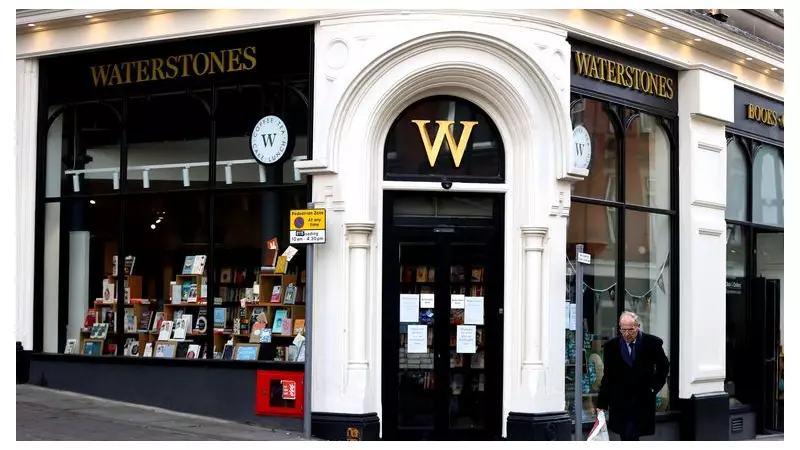

The group, which operates the Waterstones chain in the UK and Barnes & Noble in the United States, represents one of the world's leading physical book retailers. In Britain alone, Waterstones trades from approximately 315 shops and employs around 4,000 people.

Leadership and Government Backing

The company has undergone a significant transformation under the leadership of James Daunt, who is both the CEO of the Elliott-owned group and the founder of the separately-owned Daunt Books chain. His strategy has been widely credited with revitalising the high-street bookseller.

The move towards a London listing has received political encouragement. In October 2025, Sky News reported that Mr Daunt attended a roundtable discussion hosted by Chancellor Rachel Reeves, aimed at promoting the London Stock Exchange as a premier listing venue for major companies.

Next Steps for the Flotation

While Rothschild is being lined up to act as an independent adviser on the flotation options, a number of other banks will be appointed in the coming months to oversee the intricate process of the public listing and the subsequent sale of shares. The Financial Times reported last month that the company had already begun talks with potential advisers, signalling the advanced stage of planning.

The prospective IPO of Waterstones and Barnes & Noble is set to be a closely watched test of investor appetite for London's public markets in 2026, highlighting the resilience of the physical retail sector under adept management.