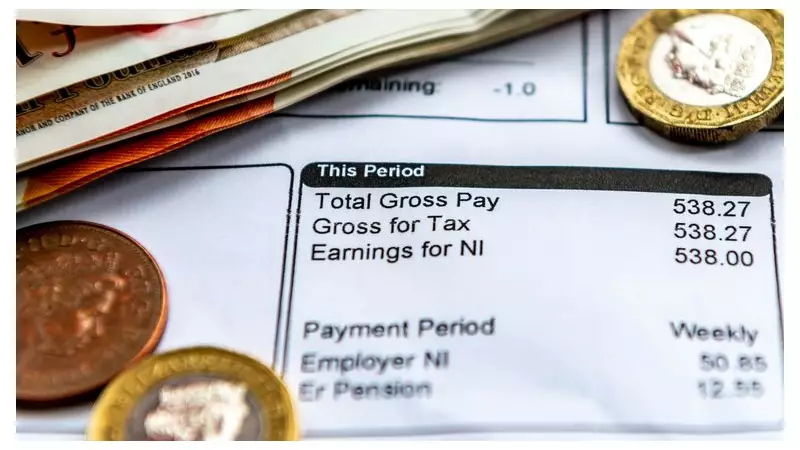

Newly released figures have exposed a massive tax overpayment problem in the UK, with millions of people paying more than they owe due to systemic errors.

Billions Overpaid in Income Tax

Data obtained from HM Revenue and Customs (HMRC) shows that in the 2023/24 financial year, more than 5.6 million individuals overpaid their income tax. The collective sum of these overpayments reached a staggering £3.5 billion.

The revelations came to light after accountancy firm UHY Hacker Young submitted a Freedom of Information request. Neela Chauhan, a partner at the firm, stated that HMRC often operates on assumptions about people's earnings, leading to widespread mistakes. "Millions of people are paying the wrong amount of tax simply because HMRC is almost guessing what they earn," she said.

Why Tax Codes Go Wrong

The core of the issue lies with incorrect tax codes, which are used by employers and pension providers to deduct the right amount of tax. HMRC can issue the wrong code for several reasons, placing the burden on taxpayers to spot errors.

Common causes include:

- HMRC assuming an employee still receives company benefits, like a car or private healthcare, after they have stopped.

- Incorrect assumptions about additional income from sources like property rental, dividends, or freelance work that is no longer active.

- Confusion over how many jobs a person holds.

- Out-of-date or delayed information from an employer's payroll.

"For too many people, this will go completely unnoticed," warned Chauhan. She emphasised that HMRC does not always correct these mistakes automatically.

The Onus is on the Taxpayer

Experts are urging individuals to take proactive steps to ensure they are not losing money. The responsibility falls squarely on taxpayers to review their financial documents and challenge inaccuracies.

Neela Chauhan advises people to regularly check their tax codes and their year-end PAYE summaries, particularly those with any non-PAYE income or former company benefits. Identifying an error is the first step to claiming a refund from the tax office.

This situation highlights the complexities of the UK's tax system and the critical importance of personal financial vigilance. With billions of pounds erroneously collected, the call for taxpayers to scrutinise their codes has never been more urgent.