Across the continent, a simmering crisis over the future of state pensions is boiling over into political turmoil and public protest. From the streets of Paris and Madrid to the corridors of power in Berlin, European governments are grappling with a fundamental dilemma: how to sustain generous retirement promises in the face of ageing populations and falling birthrates.

The Unravelling of a Social Contract

The right to a decent state pension has been a cornerstone of the European social model for generations. However, this contract is under severe strain. People are living longer, while birthrates are in decline across the continent. This creates a simple but devastating arithmetic problem for the predominant "pay as you go" systems, where today's workers fund today's pensioners.

With fewer contributors supporting a growing number of retirees for longer periods, the financial sustainability of these schemes is rapidly eroding. While occupational and private pensions form an important part of income in some nations, the state pension remains a vital welfare pillar for millions. Attempts to cut payouts or raise the retirement age are deeply unpopular, leaving politicians in a bind, especially as the median European voter is now in their mid-40s.

The disparities are stark. Retirement ages differ by up to eight years between EU countries, and average monthly pensions range from just €226 in Bulgaria to €2,575 in Luxembourg. Alarmingly, for 80% of EU pensioners, the state pension is their sole income, with about 15% at risk of poverty.

Nations in the Eye of the Storm

France exemplifies the political volatility of pension reform. With the lowest qualifying age among major EU economies at 62, and pensioners earning fractionally more than workers on average, the system is costly at 13.4% of GDP. President Emmanuel Macron's attempts to raise the standard age to 64 provoked massive strikes and protests involving an estimated 1.28 million people in early 2023. His government ultimately forced the changes through parliament without a vote, only for the plan to be suspended until 2027 to avoid a no-confidence motion.

In Germany, the worker-to-pensioner ratio has collapsed from 6:1 in the 1960s to roughly 2:1 today. The government faces spending a quarter of its total budget next year to meet statutory pension demands. Recent legislation has set in motion a reduction in the pension value relative to average salary and plans to increase the retirement age to 67 from 2029. A growing number, particularly women, report struggling to live on their statutory pensions.

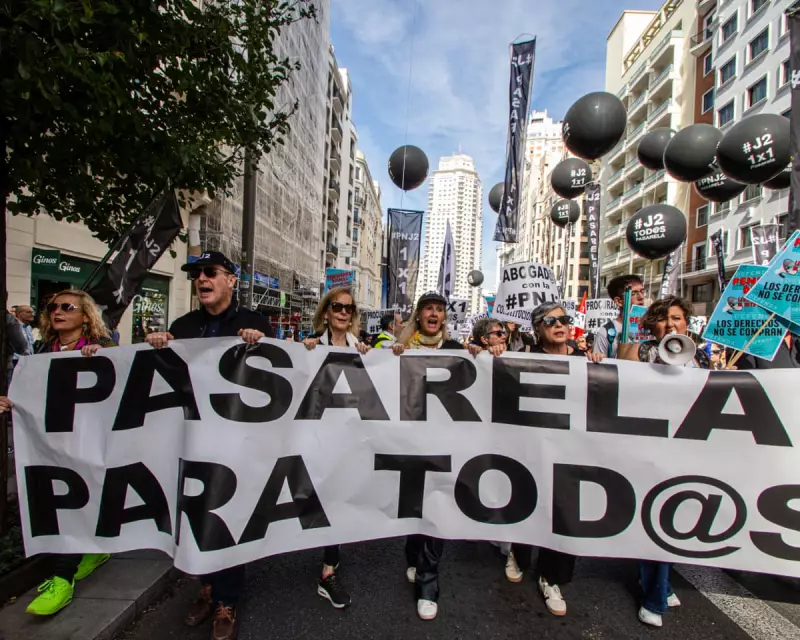

Spain, where pensions account for about 12% of GDP, is gradually raising its retirement age to 67 by 2027. The socialist-led government has introduced a "solidarity tax" on businesses and an "intergenerational equity mechanism" to bolster the pension pot. Despite government assurances of sustainability, thousands demonstrated in Madrid in October 2025 demanding a minimum pension aligned with the minimum wage and an end to the gender pension gap.

Northern Models and Rising Tensions

Denmark has long adjusted its retirement age in line with life expectancy with little fuss. However, a recent parliamentary vote to raise it from 67 to 70 by 2040—the highest in the EU—has sparked a significant debate. Prime Minister Mette Frederiksen has called for a more "lenient and fair" system, setting the stage for a potential pensions bidding war ahead of the next election. Critics argue the model is becoming "unnecessarily harsh" and reflects widening societal inequalities.

In contrast, the Netherlands is often hailed as a model, consistently ranking highly for pension adequacy. Its three-pillar system—combining state, workplace, and private pensions—costs just 6.4% of GDP. However, it too is undergoing a major shift, moving workplace schemes from defined benefit to defined contribution models, meaning future payouts are less guaranteed and more dependent on individual pot performance.

The unfolding crisis presents a stark warning. European governments must navigate the treacherous path between fiscal responsibility and social justice. The wave of protests from Paris to Madrid makes it clear: the future of retirement is now the continent's most pressing and explosive political battle.