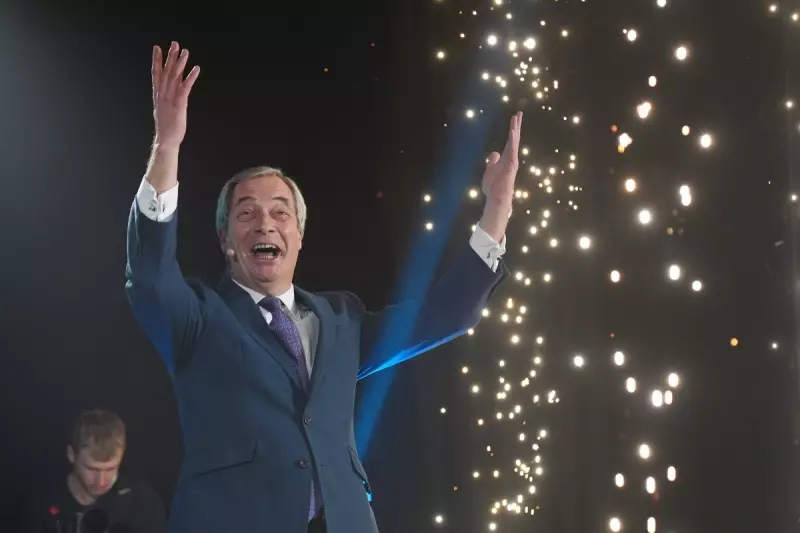

Nigel Farage Confirms Reform UK's Banking Tax Plans at Davos Summit

In a significant development that intensifies his party's ongoing friction with the financial sector, Nigel Farage has unequivocally stated that Reform UK will implement a tax on the United Kingdom's major banking institutions. The announcement was made during his address at the World Economic Forum in Davos, Switzerland, marking a dramatic escalation in the political discourse surrounding City regulation and public finance.

A Firm Stance on Banking Contributions

Speaking at a Bloomberg event within the prestigious conference, Farage framed the proposed measure not as a conventional direct tax but rather as a cessation of what he termed "free money" for banks. "This will be tough for banks to accept but I am sorry – the drain on public finances is just too great," he declared, highlighting the rationale behind the controversial policy. This stance directly challenges the banking industry, which had previously warned of "real consequences in the economy" when similar proposals appeared in Reform's manifesto.

Echoing Think Tank Recommendations

Farage's remarks align closely with recent lobbying efforts from the left-leaning Institute for Public Policy Research (IPPR). In November, the think tank urged Chancellor Rachel Reeves to introduce an £8bn levy on City banks in the Budget, specifically targeting earnings derived from quantitative easing (QE). During QE, the Bank of England purchased substantial government bonds from commercial lenders to stimulate the economy by lowering interest rates.

To finance these purchases, the central bank created new reserves for commercial banks, paying interest on them at the official rate. As interest rates surged to a post-financial crisis peak of 5.25% last year, the Bank of England found itself paying higher interest on these reserves than it earned from the bonds, resulting in projected Treasury losses exceeding £22bn annually, according to IPPR estimates.

Personal Grievances and Political Motivations

Farage did not shy away from referencing his personal experiences with the banking sector, which have clearly influenced his perspective. "Well, I don't like the banks very much because they debanked me, didn't they?" he remarked, alluding to the scandal that led to the resignation of NatWest boss Alison Rose. Coutts, a private bank within the NatWest group, had classified Farage as a politically exposed person (PEP), subjecting him to enhanced due diligence—a move he claims unfairly targeted his personal and political beliefs.

Broader Ambitions for City Reform

This banking tax proposal is merely one facet of Reform UK's broader agenda for overhauling the City of London. Deputy leader Richard Tice has previously advocated for sweeping reforms to the Bank of England as part of the party's 'Big Reform' initiative. Potential changes could include appointing Treasury representatives to the Bank's Monetary Policy Committee, a move that would significantly alter its operational independence.

The party has also criticised the Bank's regulatory approach to stablecoins—cryptocurrencies pegged to traditional currencies—labelling its officials as "dinosaur bureaucrats." During his Davos interview, Farage hinted at a strained relationship with Bank of England Governor Andrew Bailey, not ruling out the possibility of shortening his term to appoint a replacement. "I'm not questioning the independence of [the Bank]," Farage clarified, "What I am saying is that we need a new, more innovative approach to all of this."

A Lone Political Voice at Davos

Notably, Farage was the sole UK political leader in attendance at the World Economic Forum conference. Upon announcing his arrival in Davos, the Reform leader stated his intention to "confront" the views of other global leaders and engage with officials from the Trump administration, with whom he has cultivated a close relationship over the years. This presence underscores his party's growing influence and willingness to challenge established economic orthodoxies on an international stage.

The banking industry had recently avoided a tax in the Budget, with both British and American financial giants announcing substantial investments into the UK economy for the coming years. However, Farage's latest pronouncements suggest that Reform UK remains undeterred, poised to push forward with policies that could reshape the financial landscape, regardless of sector opposition.