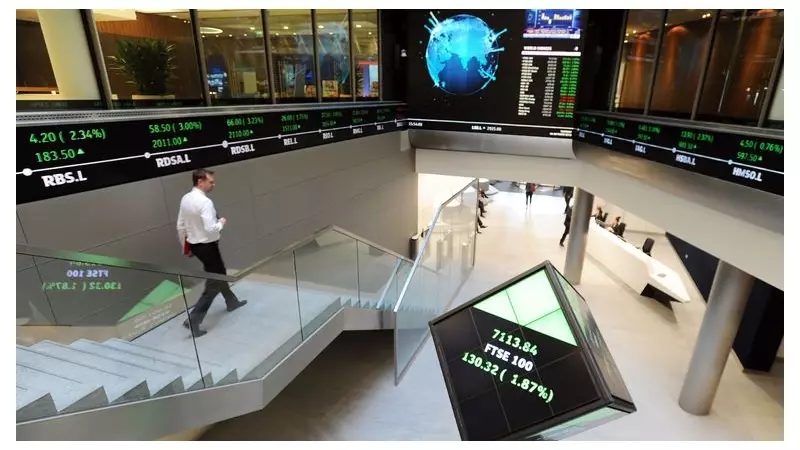

The UK's premier stock market index, the FTSE 100, has delivered its most impressive annual performance since the aftermath of the global financial crisis, closing out 2025 with a powerful rally that outpaced its major international competitors.

A Year of Record-Breaking Gains

Data from the London Stock Exchange Group (LSEG) confirms the Financial Times Stock Exchange 100 index finished the year up by a substantial 21.5% compared to its starting point in January. This represents the index's most significant annual percentage gain in 16 years, with the last comparable surge occurring in 2009.

The benchmark, which tracks the share prices of the one hundred most valuable companies listed on the London Stock Exchange, enjoyed a remarkable run of success. Throughout the twelve months, it registered an impressive 41 separate all-time high closing figures, the latest of which was recorded on 30 December. Despite flirting with the symbolic 10,000-point threshold, the index ultimately concluded the trading year at 9,931 points.

Key Drivers Behind the FTSE 100 Rally

Several interconnected factors converged to fuel the index's exceptional performance. A primary catalyst was the sustained strength in global commodity markets. The FTSE 100 has a significant weighting towards international mining and oil and gas giants, which benefited handsomely as prices for metals like gold, silver, and copper climbed to record highs. Investors, seeking stability during periods of market volatility, increasingly turned to these tangible assets.

Monetary policy also played a crucial role. The prospect of interest rate cuts from the Bank of England lifted market sentiment, making equities more attractive relative to other investments. Furthermore, a weaker pound sterling at various points during the year enhanced the appeal of UK-listed shares for international investors, as it made purchasing assets priced in pounds more affordable.

Geopolitical shifts provided an additional tailwind. The initiation of significant trade tensions by former US President Donald Trump against China and other nations from 2 April onwards prompted some investors to diversify away from an over-reliance on US markets. This search for alternatives directed capital towards other regions, including the UK.

Outperforming International Peers

The FTSE 100's robust growth allowed it to surpass the performance of several key international indices in 2025. While Germany's DAX matched the UK index's 21.5% rise, other European markets saw more modest gains. France's CAC 40 increased by just over 10%, and the broader pan-European Stoxx 600 rose by nearly 16%.

Perhaps more notably, the London benchmark also outperformed Wall Street's flagship S&P 500 index, which posted a 17% annual gain. This occurred despite a year of soaring valuations for major US technology firms, the so-called 'Magnificent 7'—including Nvidia, Apple, and Microsoft—amid an artificial intelligence investment boom.

The FTSE 100's composition, featuring heavyweight constituents like banking groups Barclays, HSBC, Lloyds, and NatWest, alongside retail giants Tesco, Marks & Spencer, and Sainsbury's, proved resilient and attractive in the year's unique economic climate, setting the stage for its standout performance.