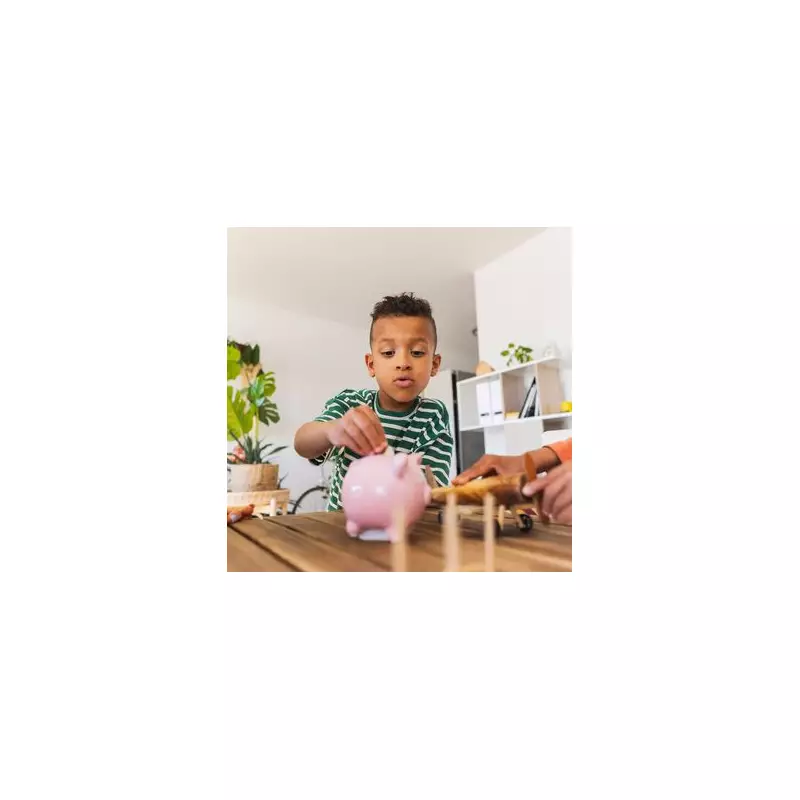

Deciding whether to give your children pocket money is a personal choice that varies from family to family. However, financial and parenting experts highlight its significant benefits in teaching young people about budgeting and saving from an early age.

When is the Right Time to Start?

There is no universal rule, but many parents begin introducing pocket money when their child is around four or five years old. This often coincides with starting school and learning basic maths, making it a practical tool for understanding addition and subtraction.

Vix Leyton, a consumer finance expert at thinkmoney, advises that the right time is as soon as a child grasps a fundamental concept. "As soon as children can grasp the idea that if you spend money, it's gone, pocket money can be useful," she says. For younger children, small amounts can teach that spending now means waiting for the next desired item.

How Much Pocket Money Should You Give?

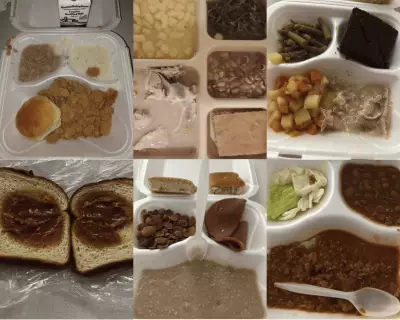

The amount varies by age and family circumstance. According to the NatWest Rooster Money Pocket Money Index 2025, the average annual income for children from allowances, chores, and rewards was £474.76, equating to roughly £9.13 per week. This marked a 1% decrease from the previous year.

The study provided a detailed breakdown of weekly averages:

- Six-year-olds received an average of £2.81.

- Seventeen-year-olds received an average of £8.31.

Leyton stresses that the figure itself is less important than how it's used. "What matters far more is how it's used as part of wider conversations about money," she explains. "It turns money from something slightly mysterious into something tangible."

The Importance of Consistency and Linking to Chores

For pocket money to be an effective educational tool, consistency is crucial. Leyton warns that without a regular schedule, parents risk becoming an "on-demand cash machine," setting a poor precedent for adult financial life.

Linking pocket money to household chores is a common practice. Matt Buttery, CEO of the Triple P UK and Ireland parenting programme, says this connection reinforces the link between effort and reward. However, he emphasises that children should also learn about intrinsic rewards. "Learning that some actions bring external rewards, like pocket money, while others bring internal rewards, like satisfaction or empathy, is a really useful life lesson," Buttery notes.

Leyton agrees but cautions that if chores are tied to earnings, expectations must be clear and consistent to avoid teaching children that negotiation trumps effort.

Building Lifelong Financial Skills

Pocket money serves as a gentle introduction to saving and budgeting. Leyton suggests it helps children build confidence and a sense of control, showing that money is about choices. As children grow older, their allowance can be used to budget for phone credit or social activities, providing a safe space to practise before the stakes become higher.

One of the most powerful lessons it teaches is patience. "The experience of spending everything immediately and then having to wait is often far more effective than any well-meaning lecture," Leyton observes. She also advises allowing children to make their own spending mistakes with small amounts, which is a cheaper lesson than similar errors with a credit card in adulthood.

Ultimately, both experts agree that pocket money is about fostering a healthy relationship with finances. "It's about raising children who aren't scared of money, and who understand it's something to be managed, talked about and learned from," concludes Leyton. Open, age-appropriate conversations at home are the best foundation for lifelong money management skills.