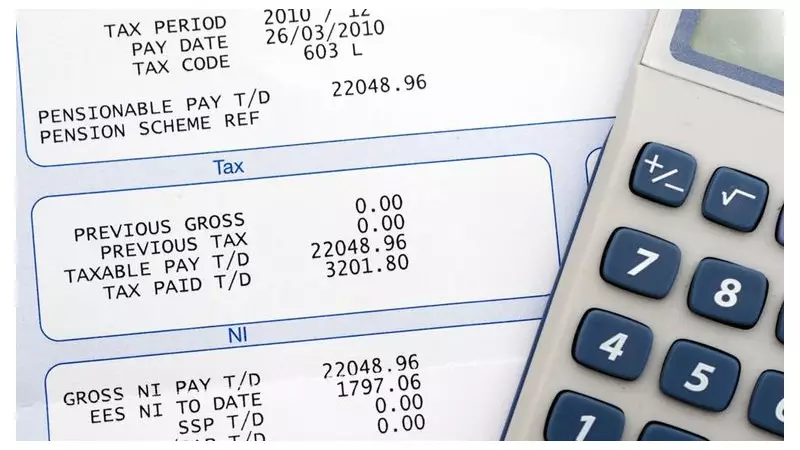

New research has revealed that millions of people across the UK could be paying too much income tax due to errors in their tax codes. Financial services provider Canada Life found that 31% of adults have been on an incorrect tax code at some point, leading to an average overpayment of £689.

Understanding Your Tax Code: The Letters and Numbers Explained

A tax code is a combination of numbers and letters used by your employer or pension provider to calculate how much income tax to deduct from your pay. The number indicates your tax-free personal allowance, but you need to add a zero to get the actual figure. For instance, the number 1257 means you can earn £12,570 before tax.

The letter that follows reveals your specific circumstances. The most common code is 1257L, where 'L' signifies you are entitled to the standard tax-free personal allowance. Other key letters include 'BR' or 'D0', which mean all your income from that source is taxed at 20% or 40% respectively, often for a second job or pension. A 'K' code means your allowances are less than your deductions, so tax is calculated on extra income.

If your code starts with an 'S' or 'C', it denotes you are a Scottish or Welsh taxpayer. The survey found that 39% of UK adults were unaware of what the letters and numbers on their tax code actually mean, highlighting a widespread knowledge gap.

Why Tax Codes Go Wrong and How to Check Yours

Errors can occur for various reasons, often when your circumstances change. Common triggers include starting a new job, having multiple incomes or pensions, receiving taxable employee benefits, or retiring. In the 2023-24 financial year alone, over 5.6 million people are estimated to have overpaid tax, partly due to incorrect codes.

Checking your tax code is straightforward. You can find it on your payslip, your P60, or by using the HMRC app or your personal tax account online. If you suspect an error, you must contact HMRC directly to correct it. You can call 0300 200 3300, use the online chat service, or write to them.

An HMRC spokesperson stated: "We don't recognise these figures. Tax codes are based on information provided by employers or pension providers. People can check their code quickly and easily online and update any details that may be affecting it."

What to Do If You've Overpaid

If HMRC agrees you have paid too much, they will typically issue a refund. However, Canada Life's research indicates a significant hurdle: over two-thirds of those surveyed did not know how to claim back overpaid tax. Furthermore, one in six adults admitted they did not know if they were currently on the correct code.

Be aware of emergency tax codes like W1, M1, or X (e.g., 1257L W1). These are temporary codes used when HMRC does not have your full details, such as when you start a new job, and are designed to ensure some tax is paid while your situation is clarified.

With the average overpayment standing at nearly £700, taking a few minutes to verify your tax code could result in a substantial and welcome refund.